Why Does a Car Stop When You Apply the Brakes? Explained Simply

Posted on 2026-01-06 08:51:38

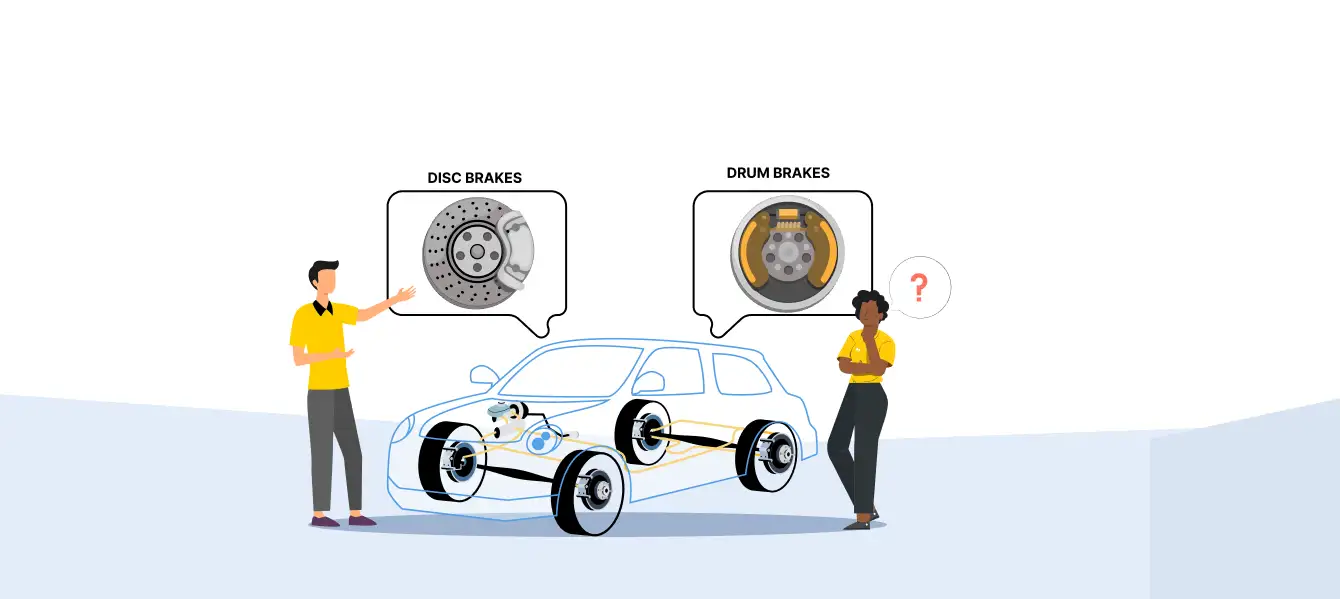

You’re driving at your usual speed, but you abruptly apply the brakes to avoid hitting someone who suddenly appears on the road ahead. While pressing the brakes certainly stops the vehicle, have you ever wondered how your foot’s little pressure can stop a multi-ton vehicle? The answer is it doesn’t. It’s the hydraulic brake system which multiplies your foot pressure to create friction between the wheels and the road. This pressure engages the car’s brake pads, which produce the friction required to slow or stop a vehicle. The science behind ‘how car brakes work?’ is fascinating, but it can be too technical for people to understand. Hence, in this blog, we’ve simplified the mechanism that runs your car’s braking system so you can better understand your car.