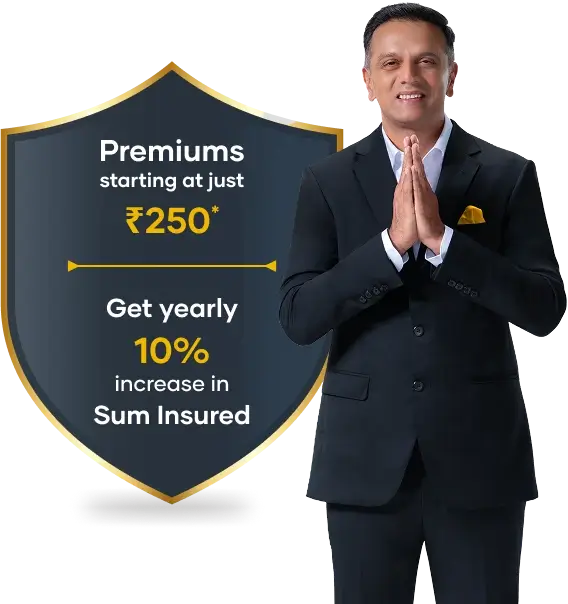

About Shriram

General Insurance

Shriram General Insurance Company is a joint venture between Shriram Capital Limited and Sanlam Limited (South Africa). We are licensed with IRDAI (Insurance Regulatory and Development Authority of India). Shriram General Insurance offers a wide range of general insurance solutions including Motor, Travel, Home and more that are designed to fit every need. So, next time when you are looking for an affordable and inclusive risk cover, insure with us and stay rest assured in life

More About Shriram General Insurance