Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

24*7 Claim Notifications

Almost 100% Paperless

Best Claim settlement Awards 2022

Shriram Motor Insurance policy has three types of insurance plans. They are Comprehensive, Standalone Own Damage (OD) and Third-Party (TP) insurance policies, depending on the scope of the coverage

Types of Shriram Motor Insurance

A Comprehensive Motor Insurance policy is the most preferred motor insurance coverage option. It provides the benefits of Third-Party (TP) coverage (coverage against third-party liabilities) and Own Damage coverage (covers damage/losses incurred to the insured and their vehicle). It also covers accidents, fire, natural disasters, man-made disasters (riots/strikes) and theft of the insured vehicle. With the Comprehensive Motor Insurance policy, Compulsory Personal Accident (CPA) cover of Rs. 15,00,000/- will always be included at an affordable premium

Coverage includes:

Standalone Own Damage (OD) motor insurance policy aids in protecting your vehicle from damages caused by unforeseen mishaps like accidents, theft, natural and man-made disasters. An OD insurance policy does not cover any third-party liabilities. Having an Own Damage motor insurance policy act as a safety shield for the insured vehicle. One can purchase Own Damage cover along with Compulsory Third-Party insurance and personal accident cover for an extensive protection

Coverage includes:

In India, Third-Party (TP) Motor Insurance is mandatory by law. A Third-Party (TP) liability motor insurance policy protects the insured against third-party liabilities. The policy provides coverage if your vehicle damages another person's vehicle/property or causes injury/death to a third-party vehicle owner. If your vehicle causes “third-party” property damage, Shriram General Insurance Company will offer compensation up to Rs. 1,00,000/- for two-wheelers and Rs. 7,50,000/- in the case of private cars. Unlimited third-party personal liability coverage will be provided, i.e. whatever the court awards as your liability to the third-party due to accidental death or injuries caused by your vehicle

Coverage includes

Choose any add-on or all of them at an additional premium for your additional safety with Shriram Motor Insurance policy

In case of accidental damage, an insured can claim the total cost of replacing vehicle parts if he/she owns a Zero Depreciation cover. There will be no deduction for depreciation on damaged vehicle parts

Daily Reimbursement is an add-on cover that reimburses for using a private vehicle while their own vehicle is being repaired. The maximum reimbursement amount and time period are provided as per the motor insurance policy guidelines

In case any motor accident arises out of the use of an insured vehicle, Shriram Motor Insurance policy will provide an advocate to guide or/and defend you from police and judicial magistrate proceedings only

Return to Invoice coverage allows an insured to receive compensation equal to the original invoice value of the vehicle (the vehicle's original purchase price), if the vehicle is stolen or suffers total loss

Personal belongings add-on cover helps with the loss of personal belongings from the locked vehicle, including vehicle accessories

During a vehicle breakdown, if an insured gets stuck in a risk-prone area such as highways and needs immediate alternate transport or hotel expenses, Shriram Motor Insurance’s Emergency Transport and Hotel Expenses cover will provide the necessary assistance

Keys are essential, but they might get misplaced or may be stolen at times. Here comes the Key Replacement add-on to save the insured at an additional cost

Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

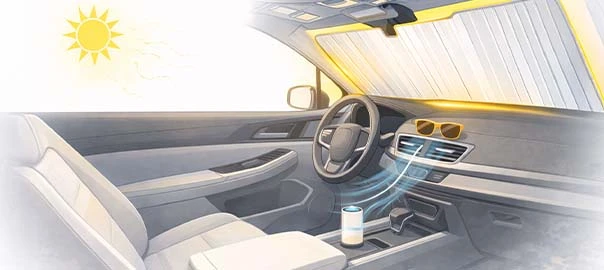

How to Protect Your Car Interior from India Extreme Summer Heat

Posted on 2026-03-06 11:30:53

How to Protect Your Car Interior from India’s Extreme Summer Heat

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure

Posted on 2026-03-05 09:29:06

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure