Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

24*7 Claim Notifications

Almost 100% Paperless

Best Claim settlement Awards 2022

Inexpensive Premium

Affordable premium rates with nil commission fees

Paperless Process

A digital-friendly process with minimal paperwork

2800+ Cashless Garages

Direct claim settlement facility at special garages

Instant Claim Settlement

Hassle-free claim settlement at your fingertips

Extensive Add-on Covers

Enhanced protection through unique add-on covers

On-time Customer Support

Round-the-clock online customer assistance

An insured can claim the No Claim Bonus up to 90 days after the expiration of the previous policy. The No Claim Bonus is reduced to 0% if the policy is not renewed within 90 days and no benefit is transferred

Yes. The existing vehicle must be sold based on the NCB reserving letter issued by the existing insurer. By transferring the NCB reserving letter, you can take advantage of continuity benefits on the new vehicle

Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

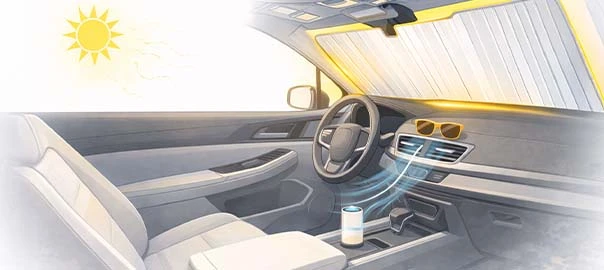

How to Protect Your Car Interior from India Extreme Summer Heat

Posted on 2026-03-06 11:30:53

How to Protect Your Car Interior from India’s Extreme Summer Heat

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure

Posted on 2026-03-05 09:29:06

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure